Why European Manufactured Medical Devices Matter More Than Ever

EU bans Chinese firms from high‑value medical contracts

On June 20, 2025, the European Commission officially barred Chinese companies from bidding on medical-device tenders over €5 million, citing unfair access in China and discriminatory procurement practices. This action affects 60% of the EU’s public procurement value and marks the first application of the International Procurement Instrument (IPI)—a strong statement about fair competition and sovereignty in healthcare sourcing.

What this development means for hospitals and procurement teams

The EU is pushing for local and trusted suppliers.

Sourcing decisions are no longer just about price—they’re also about security, transparency, and control.

EU-made medical devices now hold strategic and financial advantages in large-scale tenders.

Why It Matters That We Manufacture in the Netherlands and France 🇳🇱🇫🇷

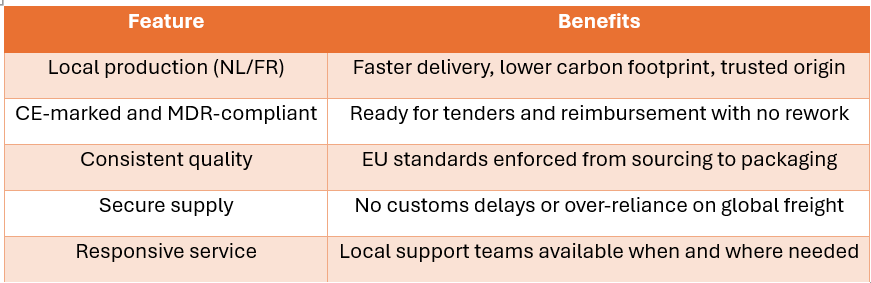

1. Shorter supply chains = faster fulfilment

By producing in France and the Netherlands, TSC Life delivers consistent product availability without international shipping bottlenecks. In an industry where timing is critical, local production ensures speed and reliability.

2. Full CE and EU MDR compliance

Our devices comply fully with EU Medical Device Regulation (MDR) and bear the CE mark, meaning they meet Europe’s most stringent safety, performance, and quality standards. There’s no need for re-certification or interpretation—they’re ready to go.

3. Access to French incentives and preferential pricing

France’s Health Innovation Plan 2030 promotes EU-made medical devices through tools like CSIS pricing credits, rewarding local innovation and production. Buyers of our products may benefit from pricing advantages and reimbursement alignment when choosing devices made in France.

4. Riding Europe’s MedTech growth

Europe’s medical device market is the second largest globally and projected to grow from $140 billion in 2022 to $171 billion by 2027. Outsourcing within the EU—particularly to trusted manufacturers in France and the Netherlands—is rising rapidly. The EU outsourcing market reached $30.4 billion in 2024 and is growing at over 12% CAGR.

5. Lower regulatory and geopolitical risk

With rising trade tensions, tariffs, and export controls, sourcing from outside the EU is increasingly risky. By contrast, EU-based suppliers offer legal clarity, stability, and long-term strategic alignment with European public health goals.

How TSC Life Brings EU Value to the Forefront

Procurement is changing. Choose a partner already aligned with the future.

References

- EU bars Chinese firms from most medical device tenders – Reuters, June 20, 2025

https://www.reuters.com/business/healthcare-pharmaceuticals/eu-bars-chinese-firms-most-medical-device-tenders-2025-06-20 - EU restricts Chinese medical devices in new trade dispute – Financial Times, June 20, 2025

https://www.ft.com/content/ef82222b-f616-493a-b863-59adb40e68d5 - EU spurns economic dialogue with China over deepening trade rift – Financial Times, June 21, 2025

https://www.ft.com/content/81700fc4-8f23-4bec-87e9-59a83f215431 - International Procurement Instrument (IPI) – European Commission

https://policy.trade.ec.europa.eu/international-procurement-instrument_en - Medical Devices Regulation (EU MDR) – European Medicines Agency (EMA)

https://www.ema.europa.eu/en/human-regulatory/overview/medical-devices - Health Innovation Plan 2030 – French Ministry of Health (Ministère de la Santé)

https://solidarites-sante.gouv.fr/actualites/presse/dossiers-de-presse/article/health-innovation-plan-2030 - European MedTech Market Outlook 2022–2027 – MedTech Europe

https://www.medtecheurope.org - EU Medical Device Outsourcing Market Report 2024 – ResearchAndMarkets.com

https://www.researchandmarkets.com/reports/5795462/europe-medical-device-outsourcing-market